25+ hecm vs reverse mortgage

Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. There are several kinds of reverse mortgage loans.

Difference Between A Hecm Mortgage And A Reverse Mortgage

Ad Compare the Best Reverse Mortgage Lenders In The Nation.

. Web FHA insured reverse mortgages called HECMs allow seniors to withdraw cash from their home while retaining the right to live there indefinitely. Learn About Reverse Mortgages With a Free Info Kit From AAG Americas 1 Reverse Lender. HECMs are backed by the US.

In other words the HECM loan allows qualifying homeowners to age in place and access their home equity to pay for needs and wants they may have later in life. Learn About Reverse Mortgages With a Free Info Kit From AAG Americas 1 Reverse Lender. Ad Understand the Downsides of a Reverse Mortgage Loan So You Can Make Informed Decisions.

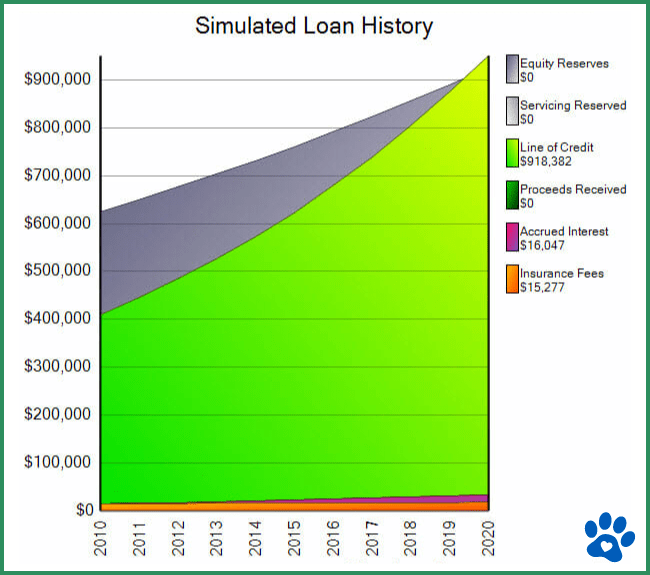

Historically 90 of all reverse mortgages were HECMs. Web With a reverse mortgage loan the amount the homeowner owes to the lender goes upnot downover time. Web The HECM program was designed to allow senior homeowners who are age 62 or older to tap into their home equity via a reverse mortgage while they still live in their homes.

Get a Free Information Kit Reverse Mortgage Calculator and Consumer Guide. Ad Take Our Suitability Test and find out if a Reverse Mortgage is the Right Choice. Web 1 day agoMarch 8 2023 127 pm By Chris Clow.

Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. The only reverse mortgage insured by the US. 2 proprietary reverse mortgage loans that are not FHA-insured.

Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. 1 those insured by the Federal Housing Administration FHA. The cash you receive is typically tax-free and.

In fact it was not until 1989 that the Federal Housing Association insured the first. A reverse mortgage loan is not free money. Compare a Reverse Mortgage with Traditional Home Equity Loans.

Web The good news is that the HECM program can be used to hedge against that risk as well. Eligible borrowers qualify to receive disbursements either as a lump sum payment monthly payment or line of credit. Reverse Mortgages Have Helped Thousands of Retirees.

Proprietary reverse mortgage lenders may allow higher loan amounts in that case proprietary reverse mortgages are. Ad 2023s Trusted Reverse Mortgage Reviews. These loans are only available through an FHA.

Web HECM reverse mortgages can help homeowners who cant qualify for cheaper financing like home equity loans because of credit problems or insufficient. Federal Government is called a Home Equity Conversion Mortgage HECM and is only available through an FHA-approved lender. Web Reverse mortgages are increasing in popularity with seniors who have equity in their homes and want to supplement their income.

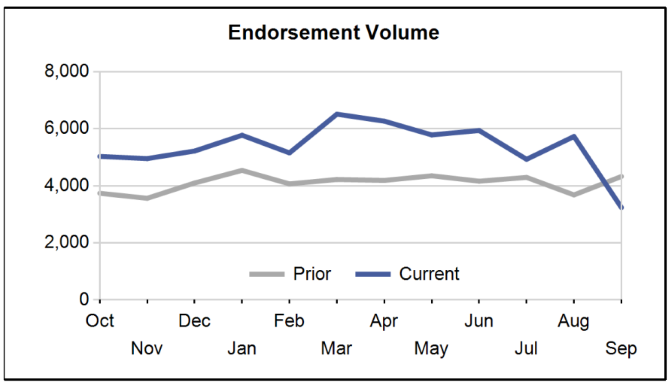

Like a traditional mortgage some of the costs incurred when getting a reverse mortgage are tax deductible. Home Equity Conversion Mortgage HECM for Purchase H4P business remains a fraction of total HECM volume but H4P. It is a loan where borrowed money interest.

They are a potentially powerful tool for. Learn Why Retirees Trust Longbridge. The Home Equity Conversion Mortgage is offered to those over age 62 amid a plethora of multiple.

Department of Housing and Urban Development HUD. Web HECM vs. As your loan balance increases your home equity decreases.

There are reasons for this. And 3 single-purpose reverse mortgage loans. Ad Understand the Downsides of a Reverse Mortgage Loan So You Can Make Informed Decisions.

Get Free Info Now. Web A Home Equity Conversion Mortgage HECM is a reverse mortgage that is backed by the federal government and it allows senior homeowners to tap into their homes equity. Ad Reverse Mortgages Are More Common Than You Think.

An example of costs that can be claimed are reverse. Web Home Equity Conversion Mortgage HECM is the only type of reverse mortgage that is federally insured. This is because interest and fees are added to the loan balance each month.

Web Even though reverse mortgages go back to the 1960s the term HECM is far newer. Web A home equity conversion mortgage HECM is a federally insured reverse mortgage that allows you to receive a cash payment from your home equity every month using your home as collateral. Web What is the Difference Between HECM Loans and a Reverse Mortgages.

If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. But today jumbo reverse mortgages comprise 25 of all reverse mortgages by volume. Learn About This Mainstream Movement.

Comparisons Trusted by 45000000. Consider the case of a male retiree of 64 with 500000 of financial assets and 500000 of equity in his.

October 2 2017 Changes To The Hecm Reverse Mortgage

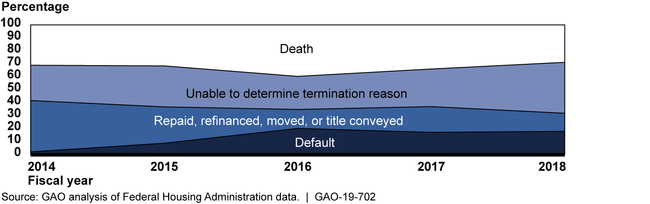

Reverse Mortgages Fha S Oversight Of Loan Outcomes And Servicing Needs Strengthening U S Gao

Reverse Mortgage Als Instrument Zur Alterssicherung In Deutschland Moglichkeiten Und Grenzen Grin

What Is Reverse Mortgage Types And Advantages Analytics Steps

Reverse Mortgage Net

What Is A Reverse Mortgage How Does It Work Reverse Mortgage Colorado

How Does A Reverse Mortgage Work A Real World Example

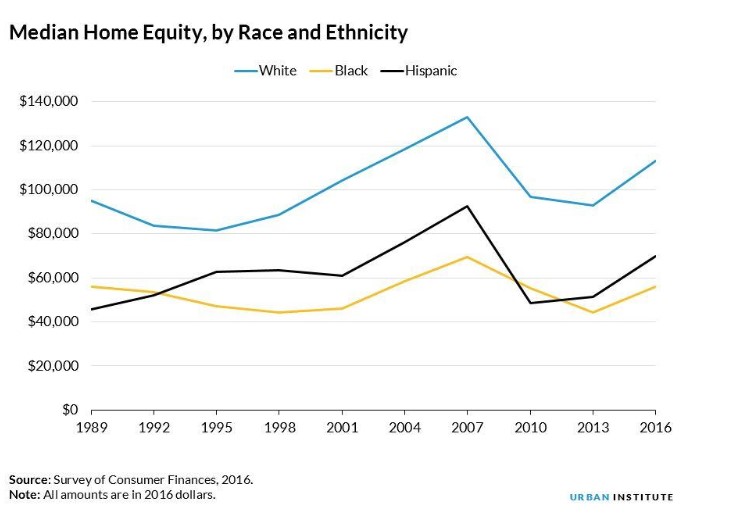

Urban Institute Reverse Mortgage Use Differs By Race And Ethnicity Nrmla

Mlo Mentor The Hecm Reverse Mortgage

Reverse Mortgages Guide

These Were The Biggest Reverse Mortgage Trends In 2022 Reverse Mortgage Daily

Reverse Mortgage Calculator Aag

What Is A Reverse Mortgage Pros And Cons Explained

The Reverse Mortgage Refi Boom Is Over Nmp

What Is A Reverse Mortgage Explaining What A Hecm Is

What Is A Reverse Mortgage And How Does It Work Mutual Of Omaha Reverse Mortgage

Reverse Mortgages Get No Respect Squared Away Blog